25 Jul 2025

How Zerodha grows

Context

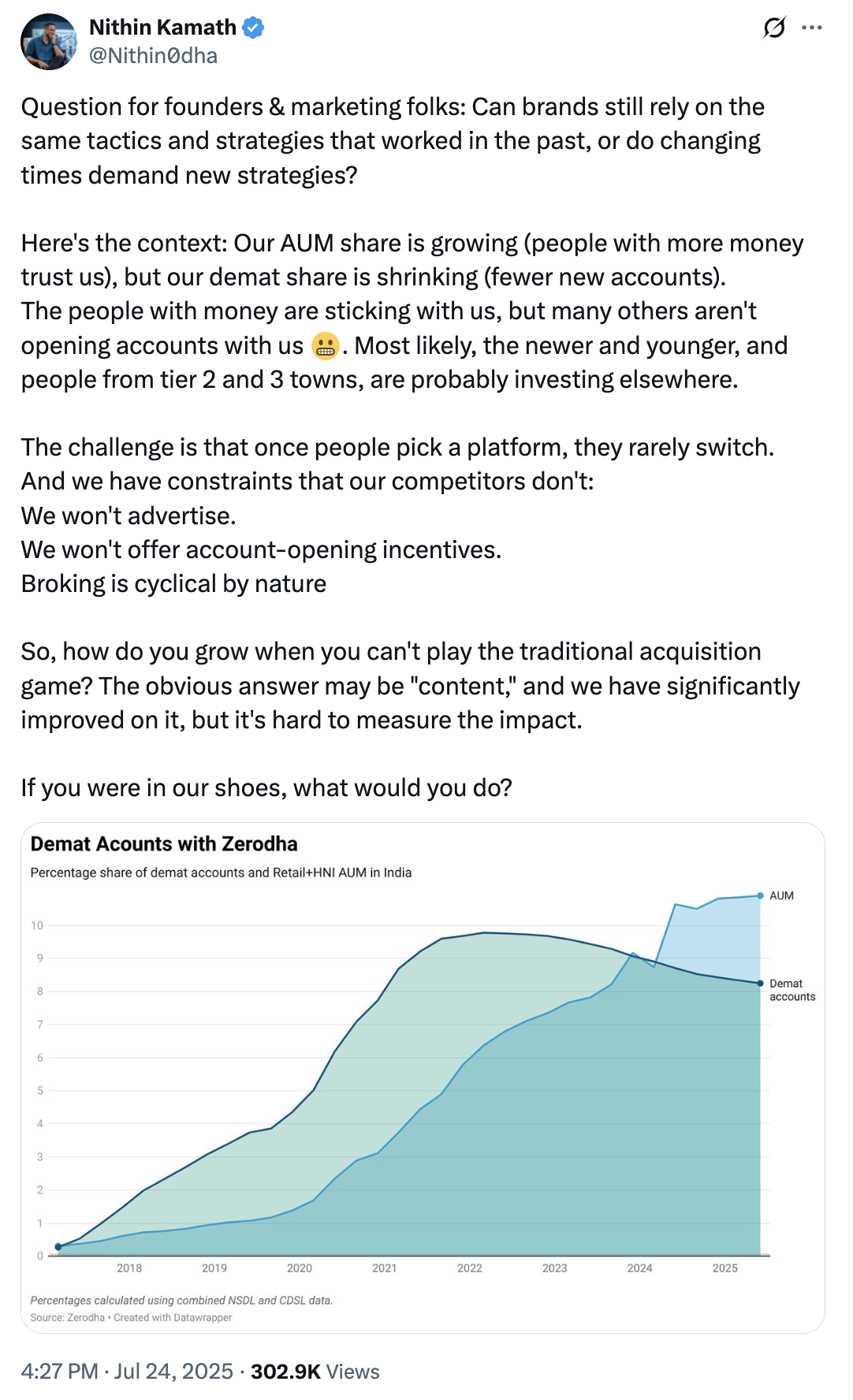

Zerodha’s founder recently posted this tweet:

My thoughts

Appreciate the humility of this post. Long-time Zerodha user here - invested my first salary through Coin, brought my entire family and close friends onboard.

The Core Problem

I think the core problem here is that Zerodha, the product, has lost its identity. As a user, I just don’t know what the product stands for anymore.

5-7 years ago, Zerodha was a clear trusted stand-out against the dark patterns of incumbents. Transparency, clean UX, no push notifications - all aided that product story. But these principles are table stakes now and the story is old. The “no permissions” tweet doesn’t invoke any user goodwill/emotion anymore.

Today, I know what the Kamath brothers stand for, I know the bootstrapped story, I know what Rainmatter stands for, I know the fitness story.

But I just don’t know what Zerodha, the product, stands for in 2025.

Compare this with, say, INDMoney - horrible UX, but crystal clear value prop in my head as the “one-stop shop for all family finances.” I add my family there, I track my RSUs, I do US stocks investing there, it makes sense.

Solutions

Let’s now come back to the core stated problem: Demat share is not growing, new users are not investing.

1. Product fixes that will improve word of mouth

a) Give the market what it wants: It’s good to take a principled approach to nudge users to be cautious, but it’s also important to just listen to the market. For example, there are multiple asset classes that just don’t exist on Zerodha.

b) Simplify, simplify, simplify: Why are Coin and Kite different? Why do I need a web view and multiple re-directs to add money to my portfolio from the app?

c) Solve the paper cuts: Product hygiene is tablestakes now. I recently partially shifted from Coin because I couldn’t see long term/short term gains before selling my MFs. The AI dev productivity boon needs to accelerate these fixes.

2. Growth plan of action

Start off by accepting that all growth is not dark patterns. It was a rational decision to ignore growth tactics when brand principles were fuelling growth, but if not now, maybe the constraints are self-imposed and worthy of some evolution.

a) Challenge the assumption “once people pick a platform, they rarely switch”. Transfer incentives work, with enough precedence in the US market. LTV of retained users makes up for the money spent and accelerates new user growth through referrals - this is not just burning cash.

b) Rethink content strategy: Is the current strategy too broad and just expanding the pie, with majority share going to competitors?

c) Basic PLG quick wins: Achievement systems, social proof, micro-influencer partnerships.

3. One big bet: Launch a bold sub-brand

Launch a “Zerodha Labs” product. Compete head-on with competitors. Have the luxury to play with the above principles without hurting the original brand’s trust equity that brings in the high AUM audience, but also gets the new age investor who finds Coin/Kite boring.